35+ what type of mortgage should i get

Web You can get an FHA mortgage with only a 35 down payment though a credit score less than 580 requires up to 10. If the base rate is reduced by the Bank of England your mortgage payment will reduce.

Do Lenders Have Minimum Mortgage Amounts 2023 Rules

Web A fixed-rate mortgage carries the same interest rate throughout the life of the loan.

. Contact a Loan Specialist. The rate tracks a fixed economic indicator usually the Bank of Englands base rate. Why Rent When You Could Own.

Web Youll typically need a credit score of at least 620 and a debt-to-income DTI ratio that is no higher than 35 to 45. Web Just know that there are special types of loans for borrowers. Check Your Eligibility for a Low Down Payment FHA Loan.

Ad First Time Home Buyers. Compare Apply Directly Online. Many tracker rates are more competitive than a lenders standard variable rate SVR Some tracker rates may be cheaper than fixed rates.

Web Tracker mortgage. Ad First Time Home Buyers. Ad Compare Lowest Mortgage Refinance Rates Today For 2023.

Borrowers can get a conventional loan with a down payment of as little as 3 percent. For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000. While 15-year fixed-rate mortgages require higher monthly payments they also tend to have lower interest rates and allow you to pay off your loan more quickly.

All FHA mortgages require private mortgage insurance. Compare More Than Just Rates. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. The Best Lenders All In 1 Place. Low Fixed Mortgage Refinance Rates Updated Daily.

Ad Best Mortgage Loans Compared Reviewed. If the base rate is increased by the Bank of England your mortgage payment will increase. Web There are literally thousands of different types of mortgages on the market and choosing one can be daunting.

Jumbo loans are for amounts above this conforming limit up. With a conventional mortgage you dont pay for mortgage insurance if you make a down payment of 20 or more. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Get Your VA Loan. This doesnt mean its the same as the base rate just that it moves in line with it. Compare More Than Just Rates.

Web In 2022 the maximum amount you can get through a conventional conforming loan the most common loan type in most areas is 647200. An adjustable-rate mortgage has an introductory fixed-rate period usually five seven or 10 years. VA Loan Expertise Personal Service.

The Search For The Best Mortgage Lender Ends Today. With a Low Down Payment Option You Could Buy Your Own Home. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability.

Generally lenders will want you to have your monthly mortgage payment and other debt payments under 36 of your gross monthly income. But youll also need to document that you have the income to cover the. Apply Easily Get Pre Approved In Minutes.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. With a Low Down Payment Option You Could Buy Your Own Home. Web Heres how they work.

With a military connection. Fast VA Loan Preapproval. Web Most lenders will want to see that your monthly mortgage payment including taxes insurance and all other fees does not exceed 28 of your gross or before-tax monthly income.

Web Conventional mortgages can be either 15- or 30-year loans with 30-year fixed-rate loans being the most common type. Which one is right for you depends on your circumstances. No SNN Needed to Check Rates.

See VA loans Who would like to live in a rural or suburban area. The minimum credit score requirement for a conventional loan is typically 620 or higher. Web Most home loans require a down payment of at least 3.

Check Your Eligibility for a Low Down Payment FHA Loan. Web Types of mortgages Conventional loan Best for borrowers with a good credit score Jumbo loan Best for borrowers with excellent credit looking to buy an expensive home Government-insured loan. Find A Lender That Offers Great Service.

They may also have lower interest rates because the loan is secured. But before deciding which mortgage to go for you need to decide what type of mortgage to get repayment interest only fixed tracker or discounted. Trusted VA Loan Lender of 300000 Veterans Nationwide.

Take the First Step Towards Your Dream Home See If You Qualify. Tracker mortgages usually track above the base rate. Ad Tired of Renting.

Take the First Step Towards Your Dream Home See If You Qualify. See USDA loans Who have a lower. Web Fixed-rate mortgages are available for as long as 30 years but other terms such as 15 or 20 years are also options.

Web 21 hours agoThis type of financing might be easier to get than other loans like unsecured personal loans if you have bad credit. Find A Lender That Offers Great Service. Compare Apply Get The Lowest Rates.

Home Appraisal And Your Property Value

35 Different Types Of Houses For Your Future Home

What Type Of Mortgage Should I Get Money Guru

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

Fha Loan Calculator Check Your Fha Mortgage Payment

42 Mortgage Broker Canva Templates Social Media Marketing Etsy Uk Mortgage Brokers Mortgage Marketing Mortgage

35 Costly Medical Bankruptcy Statistics Etactics

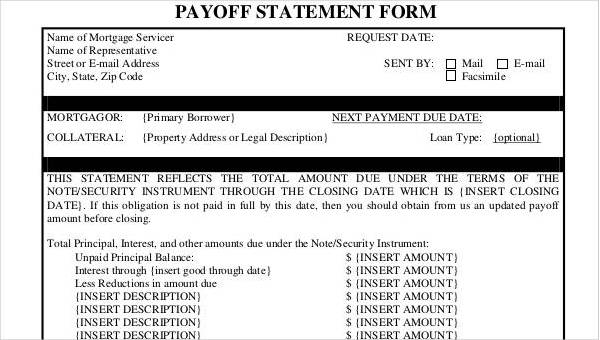

Free 35 Printable Statement Forms In Pdf Excel Ms Word

Home Loan Melbourne Finding A Loan When You Re Self Employed

Mortgage Industry Veteran Peter Garvin Joins Zenith Home Loans As The Director Of Business Development

Adjustable Rate Mortgage What Is It And How Does It Work

Mortgage Broker Baulkham Hills Castle Hill Kellyville Mortgage Choice

Types Of Home Loans Find The Best Mortgage For You 2023

5 Ways A Reverse Mortgage Can Improve Your Retirement Keil Financial

Fha 203k Loan Renovation Mortgage Loans Explained

Our Personalised Home Loan Advice Mortgage Choice

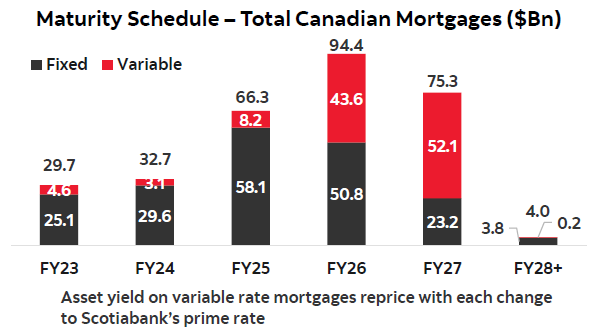

The Variable Customer Is In Good Shape Says Scotiabank Mortgage Rates Mortgage Broker News In Canada